& Simpler Trading

Good day, 360!

Here are some of our top movers today. And don’t forget to join us in Market Masters – the hottest trading room around 🔥. Be the best prepared trader on the Street!

FOCUS LIST🔎

SNOA – Up over 120% in the pre-market after announcing launch of diaper rash product in Walmart and other U.S. chains

XPON – Up over 130% in pre after announcing better than expected financial results

AERT – Up over 60% in pre after reporting record financial results

*together with Simpler Trading

⏰Today At 1PM ET!⏰

Monster MOMO With John Carter & Jeff Bishop

The #1 Strategy John Trusts With BIG Positions

Aiming For Triple & Quadruple-Digit Returns!

HOTLIST🔥

SNOA – Up over 120% in the pre-market after announcing launch of diaper rash product in Walmart and other U.S. chains

Sonoma Pharmaceuticals Inc. (SNOA) is a global healthcare leader developing and producing patented Microcyn® technology based stabilized hypochlorous acid (HOCl) products for a wide range of applications, including wound care, eye, oral and nasal care, dermatological conditions, podiatry, and animal health care.

In the after-hours yesterday, the company announced the launch of its HOCl-based diaper rash product for infants and children into large retailers in the United States.

The antimicrobial hydrogel is being marketed and sold through Sonoma’s U.S.-based distribution partner. The diaper rash product is currently carried in 3,600 Walmart stores, Amazon.com, and certain large grocery chains.

Shares of SNOA traded up over 120% in the pre-market in reaction to the news.

The $6.40 area acted as support in the pre-market and will be an important level to watch.

Above it, targets to the upside are $7.20, $7.40 and then the pre-market high at $8.32. Beyond that, $8.50, $9 and $9.37 come into play.

Below $6.40, targets to the downside are $5.70, $5, $3.80 and then a gap fill at $3.05.

XPON – Up over 130% in pre after announcing better than expected financial results

Expion360 Inc. (XPON) is an industry leader in lithium iron phosphate battery power storage.

In the after-hours yesterday, the company reported its financial and operational results for the first quarter ended June 30, 2025.

Highlights include:

Q2 2025 net sales totaled $3.0 million, up 134% from Q2 2024, and up 46% from Q1 2025.

First half 2025 net sales of $5.0 million, up 124% from the first half of 2024.

6th consecutive quarter of sales growth.

Gross profit increased 91% compared to Q2 2024.

First half 2025 operating cash burn improved 52% compared to the first half of 2024.

$1.4 million in cash, cash equivalents and accounts receivable.

Regained compliance with Nasdaq Listing Rule 5550(a)(2) as of August 13, 2025.

Shares of XPON traded up over 130% in the pre-market in reaction to the news.

The $2.60 area acted as support in the pre-market and will be an important level to watch.

Above it, targets to the upside are $3, $3.20 and then the pre-market high at $3.50. Beyond that, $4, $4.40 and $5.50 come into play.

Below $2.60, targets to the downside are $2.35, $2, $1.60 and then a gap fill at $1.31.

*sponsored by Pacaso

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

AERT – Up over 60% in pre after reporting record financial results

Aeries Technology, Inc. (AERT) is a global leader in AI-powered business transformation and Global Capability Center (GCC) services.

In the pre-market this morning, the company announced financial results for the first quarter ended June 30, 2025 — the strongest first quarter in Company history delivering positive operating cash flow and a $17.0 million year-over-year improvement in net income..

Highlights include:

Revenue: $15.3 million, driven entirely by strong demand for core AI-powered GCC services.

SG&A Expenses: Reduced by more than 85% year-over-year, helping to create a leaner, scalable cost base.

Operating Profit: $0.8 million, up $17.2 million year-over-year.

EBITDA: $2.3 million; Adjusted EBITDA of $1.0 million

Net Income: $1.7 million, compared to a $15.3 million net loss in Q1 FY2025 – a $17.0 million improvement.

Cash Flow from Operations: $1.4 million, reversing negative cash flow, as compared to the first quarter of FY2025.

Shares of AERT traded up over 60% in the pre-market in reaction to the positive results.

The $1.30 area acted as resistance in the pre-market and will be an important level to watch.

Above it, the first target is the pre-market high at $1.38. Beyond that, $1.50, $1.60, $1.75, $1.90, $2 and $2.15 come into play.

Below $1.30, targets to the downside are $1.15, $1.11, $1, $0.93, $0.81 and then a gap fill at $0.70.

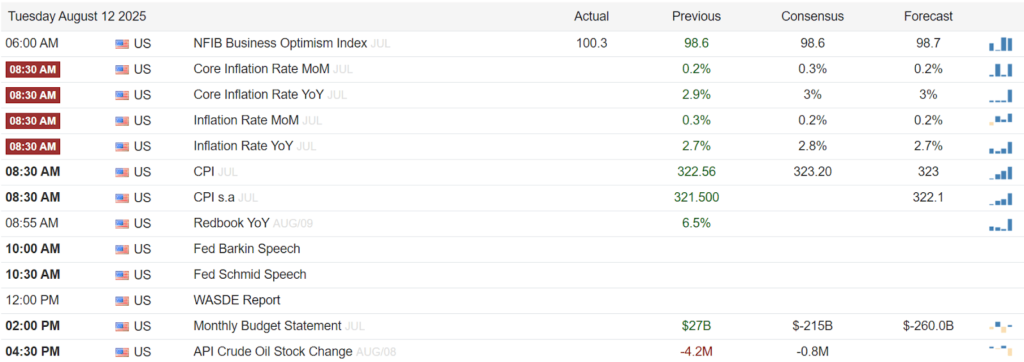

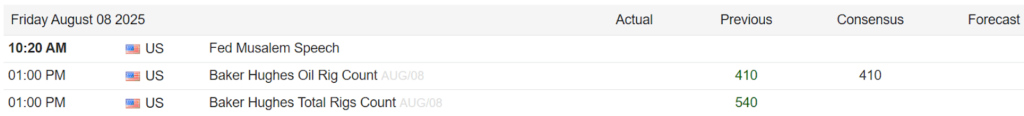

MARKET NEWS 📰

DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). Full disclaimer: https://bullseyealerts.com/disclaimer/

SPONSORED CONTENT & COMPENSATION: You should assume we receive compensation for any non-SV purchases through links in this email via affiliate relationships, direct/indirect payments from companies or third parties who may own stock in or have other interests in promoted companies (“Clients”). We may purchase, sell, or hold long or short positions without notice in securities mentioned in this communication.

CLIENT CONTENT: SV is not responsible for any content hosted on Client sites; it is the Client’s responsibility to ensure compliance with applicable laws.

NOT INVESTMENT ADVICE: Content is for educational, informational, and advertising purposes only and should NOT be construed as securities-related offers or solicitations. All content, regardless of characterization as “educational,” should be considered promotional and subject to disclosed conflicts of interest. Do NOT rely on this as personalized investment advice. SV strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS NOT TYPICAL: Past performance, testimonials, and historical results are unverified and NOT indicative of future results. Results presented are NOT guaranteed as TYPICAL. Past newsletters, marketing materials, track records, case studies, and promotional content should NOT be relied upon as indication of future performance. Market conditions, regulatory environments, and individual circumstances vary significantly over time. Actual results will vary widely given factors such as experience, skill, risk mitigation practices, market dynamics and capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

REGULATORY STATUS: Neither SV nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

HIGH-RISK SECURITIES: Securities discussed may be penny stocks, small-cap stocks, cryptocurrencies, options, or other highly speculative investments subject to extreme price volatility, rapid and substantial price movements, limited liquidity, regulatory changes, and potential total loss of value. Market conditions can change rapidly and unpredictably.

LEGAL: In any legal action arising from or related to SV services or these terms, SV shall be entitled to recover attorneys’ fees, costs, and disbursements in addition to any other relief.