& Simpler Trading

Good day, 360!

Here are some of our top movers today. And don’t forget to join us in Market Masters. And an extra heads up to reserve your seat for this upcoming special event:

Clear your schedule – it will be worth it 🔥

FOCUS LIST🔎

GEVO – Up over 39% in pre after reporting bettar than expected financial results

WOW – Up over 48% in pre after reporting better than expected revenues

ATNF – Up over 30% in pre after announcing closing of private offering of approximately $156 million of convertible notes to purchase more Ethereum (ETH)

*together with Simpler Trading

Can you spot momentum? Literally the million dollar question…

And exactly why John Carter developed his [NEW] Momentum tools

Join Jeff Bishop as he welcomes one of his ALL-TIME FAVORITE traders for the FIRST time to the Market Master’s Room.

HOTLIST🔥

GEVO – Up over 39% in pre after reporting better than expected financial results

Gevo, Inc. (GEVO) is a leading developer of cost-effective, renewable hydrocarbon fuels and chemicals that also can deliver significant carbon emission abatement.

In the after-hours yesterday, the company announced financial results for the second quarter and six months ended June 30, 2025.

In a landmark milestone, the Company reported positive net income for the second quarter of 2025 and that it achieved the previously announced positive Adjusted EBITDA1 target for the second quarter and six months ended June 30, 2025, as a result of successful performance of our assets.

Highlights include:

Positive Net Income Attributable to Gevo of $2.1 million in the Second Quarter

Positive Adjusted EBITDA1 of $17 million in the Second Quarter

Revenues Increased $14 million Quarter-Over-Quarter

Positive Earnings per Share Attributable to Gevo of $0.01 for the Second Quarter

Results Driven by Successful Execution on Low-Carbon Ethanol and Carbon Capture Acquisition, First Sales of Clean Fuel Production Credits

Shares of GEVO traded up over 39% in the pre-market in reaction to the news.

The $1.70 area acted as support in the pre-market and will be an important level to watch.

Above it, targets to the upside are $1.95, $2, $2.10 and then the pre-market high at $2.18. Beyond that, $2.35, $2.40 and $2.50 come into play.

Below $1.70, targets to the downside are $1.50, $1.35 and then a gap fill at $1.25.

HBI – Up over 42% in pre after Financial Times reports Gildan Nears Deal To Acquire Hanesbrands

Hanesbrands Inc. (HBI) designs, manufactures, sources, and sells a range of range of innerwear apparel for men, women, and children in the Americas, Europe, the Asia pacific, and internationally.

Overnight, it was reported by the Financial Times that T-shirt maker Gildan nears deal to acquire US underwear group Hanesbrands.The takeover could value the US underwear-maker at approaching $5bn including debt, according to people familiar with the matter.

Shares of HBI traded up over 42% in the pre-market in reaction to the news.

THe $7 area acted as resistance in the pre-market and will be an important level to watch.

Above it, targets to the upside are $7.18 and then the pre-market high at $7.39. Beyond that, $7.60, $8 and $8.60 come into play.

Below $7, targets to the downside are $6.60, $6, $5.50, $5 and then a gap fill at $4.83.

*sponsored by Pacaso

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

ATNF – Up over 30% in pre after announcing closing of private offering of approximately $156 million of convertible notes to purchase more Ethereum (ETH)

180 Life Sciences to be rebranded as ETHZilla (ATNF) is integrating a pioneering ETH treasury strategy, the Company seeks to become a benchmark for onchain treasury management among public companies.

Yesterday, the company announcedthat it has sold approximately $156 million aggregate principal amount of senior secured convertible notes due 2028 (the “Convertible Notes”) in a private offering to an institutional investor on August 8, 2025.

The Company intends to use the net proceeds from the Convertible Note offering to purchase more ETH. The issuance of the Convertible Notes further expands the Company’s newly announced ETH treasury strategy. The Company plans to provide investors with regular updates in the near term on its Ethereum holdings to ensure maximum transparency.

Shares of ATNF traded up over 30% in the pre-market in reaction to the news.

The $4.50 area acted as support in the after-hours and now becomes a potential level of resistance.

Above it, targets to the upside are $5, $5.70, and then the pre-market high at $6.62. Beyond that, $8 and $9 come into play.

Below $4.50, targets to the downside are $4, $3.50 and then a gap fill at $3.34.

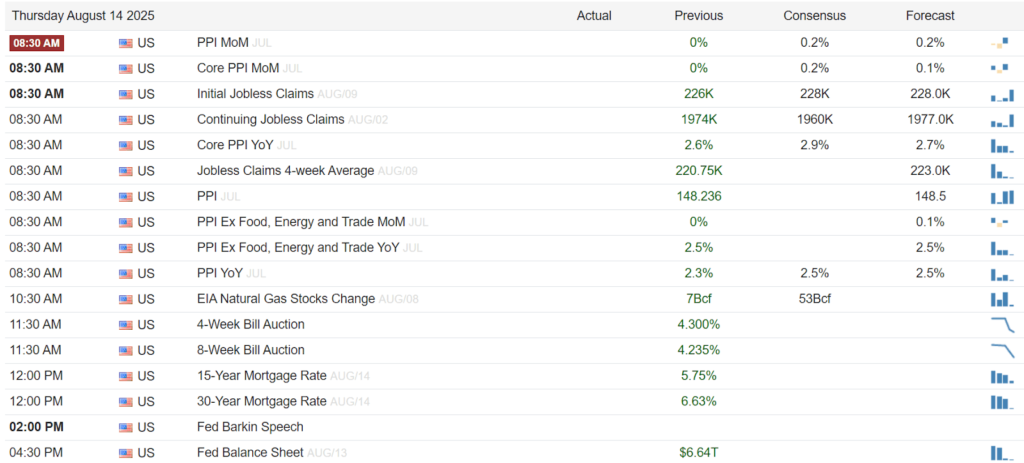

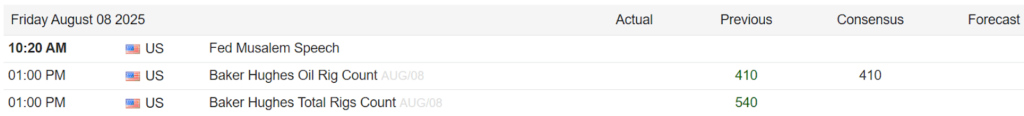

MARKET NEWS 📰

SPONSORED CONTENT & COMPENSATION: You should assume we receive compensation for any non-SV purchases through links in this email via affiliate relationships, direct/indirect payments from companies or third parties who may own stock in or have other interests in promoted companies (“Clients”). We may purchase, sell, or hold long or short positions without notice in securities mentioned in this communication.

CLIENT CONTENT:SV is not responsible for any content hosted on Client sites; it is the Client’s responsibility to ensure compliance with applicable laws.

NOT INVESTMENT ADVICE:Content is for educational, informational, and advertising purposes only and should NOT be construed as securities-related offers or solicitations. All content, regardless of characterization as “educational,” should be considered promotional and subject to disclosed conflicts of interest. Do NOT rely on this as personalized investment advice. SV strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS NOT TYPICAL: Past performance, testimonials, and historical results are unverified and NOT indicative of future results. Results presented are NOT guaranteed as TYPICAL. Past newsletters, marketing materials, track records, case studies, and promotional content should NOT be relied upon as indication of future performance. Market conditions, regulatory environments, and individual circumstances vary significantly over time. Actual results will vary widely given factors such as experience, skill, risk mitigation practices, market dynamics and capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

REGULATORY STATUS:Neither SV nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

HIGH-RISK SECURITIES:Securities discussed may be penny stocks, small-cap stocks, cryptocurrencies, options, or other highly speculative investments subject to extreme price volatility, rapid and substantial price movements, limited liquidity, regulatory changes, and potential total loss of value. Market conditions can change rapidly and unpredictably.

LEGAL: In any legal action arising from or related to SV services or these terms, SV shall be entitled to recover attorneys’ fees, costs, and disbursements in addition to any other relief.