*together with Option Pit & Stock Market Media

🏇Pick Your Pony – Both TODAY (WED)🏇

Learn to CRUSH the Close (arguably the BEST time to trade) with Voz & Mark LIVE at 2pm EST → Register for Mark & Voz.

And/OR

Learn how to wield the most powerful weapon on the market – the VWAP – with Kenny “The Warlock” Glick LIVE at 2:30pm EST → Register for Kenny.

FOCUS LIST🔎

VS – Up over 340% in the pre-market after entering agreements with ASPIS Cyber Technologies for Nasdaq compliance plan and to strengthen compliance and technology offerings

LAC – Up over 19% in pre after announcing General Motors to contribute combined $625 Million in cash and letters of credit to new joint venture

BURU – Up over 40% in pre after announcing cancellation of special proxy statement

*together with Stock Market Media

“Volume-weighted average price” – VWAP – is a force.

And it can help you make a lot of money in any kind of market.

But you have to know how to use it.

That’s where “The Warlock” Kenny Glick comes in.

HOTLIST🔥

VS – Up over 340% in the pre-market after entering agreements with ASPIS Cyber Technologies for Nasdaq compliance plan and to strengthen compliance and technology offerings

Versus Systems Inc. (VS) develops and operates a business-to-business software platform to drive user engagement through gamification and rewards in the United States and Canada.

In the after-hours yesterday, the company announced the execution of two significant agreements with Aspis Cyber Technologies, Inc. (“ASPIS”), a cloud-based mobile endpoint cybersecurity technology firm.

ASPIS is affiliated with Cronus Equity Capital Group, LLC, which holds approximately 39.5% of the Company’s outstanding common stock.

The first agreement, a Business Funding Agreement (the “Funding Agreement”), provides for ASPIS to invest $2.5 million in Versus Systems. Under the Funding Agreement, ASPIS has initially invested $500,000, and on or before November 15, 2024, ASPIS will invest the balance of $2,000,000. In exchange for the investment, the Company has issued ASPIS an unsecured convertible promissory note with a principal balance of $2,500,000.

The Note is convertible into units with each unit comprised of one common share and one warrant to purchase one half of one common share at an exercise price of $4.00 per share.

The conversion price for the Note will be at least $1.16 but will be determined by the greater of (1) the 5-day volume-weighted average price, including the date prior to the initial funding, and (2) $1.16.

The second agreement, a Technology Licensing and Software Development Agreement (the “License Agreement”), enables ASPIS to license Versus Systems’ gamification, engagement, and QR code technology for integration into its cybersecurity offerings.

Shares of VS traded up over 340% in the pre-market in reaction to the news.

The $3.93 area acted as support in the pre-market and will be an important level to watch.

Above it, targets to the upside are $5, $5.50, $6 and then the pre-market high at $6.50. Beyond that, $7.50 and $8.20 come into play.

Below $3.93, targets to the downside are $3.35, $3, $2.50, $2 and then a gap fill at $1.15.

LAC – Up over 19% in pre after announcing General Motors to contribute combined $625 Million in cash and letters of credit to new joint venture

Lithium Americas Corp. (LAC) engages in the exploration and development of lithium properties in the United States and Canada.

In the pre-markt this morning, the company announced that it and General Motors Holdings LLC (“GM”) have entered into a new investment agreement to establish a joint venture (“JV”) for the purpose of funding, developing, constructing and operating Thacker Pass in Humboldt County, Nevada. The JV Transaction will deliver $625 million of cash and letters of credit from GM to Thacker Pass alongside the conditional commitment for a $2.3 billion U.S. Department of Energy (“DOE”) loan announced earlier this year.

Under the terms of the Investment Agreement, GM will acquire a 38% asset-level ownership stake in Thacker Pass for $625 million in total cash and letters of credit, including $430 million of direct cash funding to the JV to support the construction of Phase 1 and a $195 million letter of credit facility that can be used as collateral to support reserve account requirements under the DOE Loan.

The JV Transaction replaces the $330 million Tranche 2 common equity investment commitment from GM under its original investment agreement with the Company (“Tranche 2”) announced in January 2023.

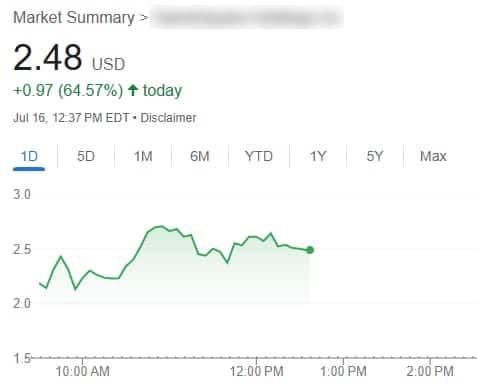

Shares of LAC traded up over 19% in the pre-market in reaction to the news.

The first target for bulls is the pre-market high at $3.34. Beyond that, $3.47, $3.83, $4, $4.20 and $4.40 come into play.

Below $3.34, targets to the downside are $3.10, $2.95, $2.90, $2.80 and then a gap fill at $2.67.

*together with Option Pit

[Happening TODAY@ 2pm EST]

Trade the Close.

LIVE Webinar w/Olivia Voznenko, aka the “Voz”

BURU – Up over 40% in pre after announcing cancellation of special proxy statement

NUBURU Inc. (BURU) is a leading innovator in high-power and high-brightness industrial blue laser technology.

In the after-hours yesterday, the company announced that it has decided to cancel the Special Proxy Statement.

The Company has not received proxies that would constitute a quorum and has decided to cancel the Special Meeting and to withdraw from consideration by the Company’s stockholders the proposals set forth in the Proxy Statement. The Company has determined to include proposals in its annual meeting proxy statement anticipated to be filed no later than October 31, 2024.

The matters submitted to stockholders at the Special Meeting, and similar matters which will be submitted again at the annual meeting of stockholders, are necessary in order for the Company to raise critical working capital to support its business plans and to continue its path to achieving commercialization. The Company has worked to secure investors and required financing; however, it cannot move forward with such financing in full unless and until it receives stockholder approval.

Shares of BURU traded up over 40% in the pre-market in reaction to the news.

The first target for bulls is the pre-market high at $1.28. Beyond that, $1.48, $2 and $2.47 come into play.

Below $1.28, targets to the downside are $1.10, $1, $0.90 and then a gap fill at $0.73.

MARKET NEWS 📰

P.S. Make sure you text “RAGE” to (888) 404-5747 to get all of our latest HOT STOCK ideas!

Questions or concerns about our products? Email [email protected] © Copyright 2022, RagingBull

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull. com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull. com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull. com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

*Sponsored Content: If you purchase anything through a link in this email other than RagingBull services, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything. We believe in the companies we form affiliate relationships with, but please don’t spend any money on these products or services unless you believe they will help you achieve your goals.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.