& Option Pit

🔥LIVE Encore At 11AM ET!🔥Olivia Voz Is Back By HUGE Demand! Encore + Q&A At 11AM ET. This Is An INVITE-ONLY Presentation. >> Special Attendee Link <<

FOCUS LIST🔎

SHPH – Up over 130% in the pre-market after announcing FDA Orphan-Drug nears patient enrollment milestone for Phase 2 clinical trial

CRVS – Up over 35% in pre after reporting better than expected financial results

GDOT – Up over 18% in pre after reporting financial results, strong revenue growth

*sponsored by 1440

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

HOTLIST🔥

SHPH – Up over 130% in the pre-market after announcing FDA Orphan-Drug nears patient enrollment milestone for Phase 2 clinical trial

Shuttle Pharmaceuticals Holdings Inc. (SHPH) is a clinical stage pharmaceutical company that develops novel therapies to cure cancers.

In the after-hours yesterday, the company announcedthat it has nearly achieved 50% enrollment in the initial randomized portion of its Phase 2 clinical trial of Ropidoxuridine for the treatment of patients with glioblastoma, with treatment sites reporting that the drug has been well tolerated and toxicity no greater than 2 on a scale of 1-5. Further, 84% of the enrolled patients have completed all seven cycles.

Shuttle has begun analyzing pharmacokinetic/pharmacodynamic samples to compare the relationship between dose and response in terms of the extent and duration of Ropidoxuridine’s action. The objective is to finalize enrollment later this year with follow up and data read out in 2026.

Shares of SHPH traded up over 130% in the pre-market in reaction to the news.

The $0.50 area acted as resistance in pre-market and now becomes a potential level of support.

Above it, targets to the upside are $0.60, $0.67, $0.8238 and then the pre-market high at $1.

Below $0.50, targets to the downside are $0.42, $0.38, $0.33 and then a gap fill at $0.27.

CRVS – Up over 35% in pre after reporting better than expected financial results

Corvus Pharmaceuticals Inc. (CRVS) is a clinical stage biopharmaceutical company that engages in the development of product candidates that precisely target proteins that are critical to immune cell maturation and function in the United States.

In the after-hours yesterday, the company provided a business update and reported financial results for the first quarter ended March 31, 2025.

Highlights include:

Soquelitinib data from cohorts 1-3 of atopic dermatitis Phase 1 clinical trial demonstrate favorable safety and efficacy profile, including earlier and deeper responses in cohort 3 compared to cohorts 1-2

Phase 3 registrational clinical trial of soquelitinib in peripheral T cell lymphoma (PTCL) enrolling with multiple clinical sites open

Early exercise of common stock warrants by stockholders providing cash proceeds of approximately $31.3 million

Shares of CRVS traded up over 35% in the pre-market in reaction to the news.

The $4.33 area acted as support in the pre-market and will be an important level to watch.

Above it, targets to the upside are $4.65, $4.81, $5, $5.25, $5.50 and then the after-hours high at $6.20. Beyond that, $6.50, $7.50 and $8.50 come into play.

Below $4.33, targets to the downside are $4, $3.80 and then a gap fill at $3.35.

*together with Option Pit

One Trade. One Time. ONE Game Plan.

Shattering Records Across The Board.

SPY Strike Zone Trades With Olivia Voz!

GDOT – Up over 18% in pre after reporting financial results, strong revenue growth

Green Dot Corporation (GDOT) is a financial technology and registered bank holding company that provides various financial services to consumers and businesses in the United States.

In the after-hours yesterday, the company reported financial results for the quarter ended March 31, 2025.

Highlights include:

Revenue growth of 24% from $451,988 to $558,874.

Increased guidance: Green Dot now expects its full year non-GAAP total operating revenues to be between $2.0 billion and $2.1 billion, up from its previous guidance range of $1.85 billion to $1.90 billion.

Green Dot now expects its full year adjusted EBITDA2 to be between $150 million and $160 million, up from its previous guidance range of $145 million to $155 million.

Company sees continued momentum in embedded finance with new Samsung and Crypto.com partnerships, and renewal of significant retail partnership

Shares of GDOT traded up over 18% in the pre-market in reaction to the news.

The first target for bulls is the pre-market high at $10.35. Beyond that $10.65, $10.80 and $11.20 come into play.

Below $10.35, targets to the downside are $10, $9.70, $9.20, $8.90 and then a gap fill at $8.70.

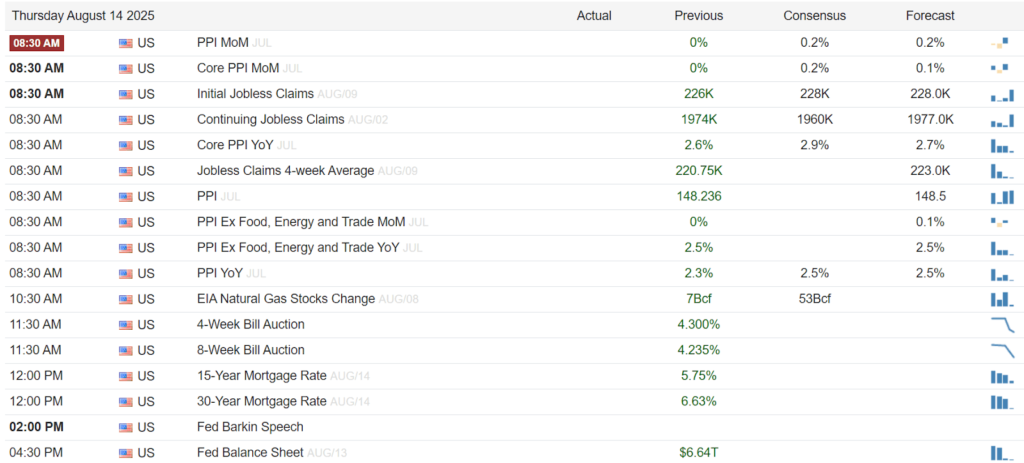

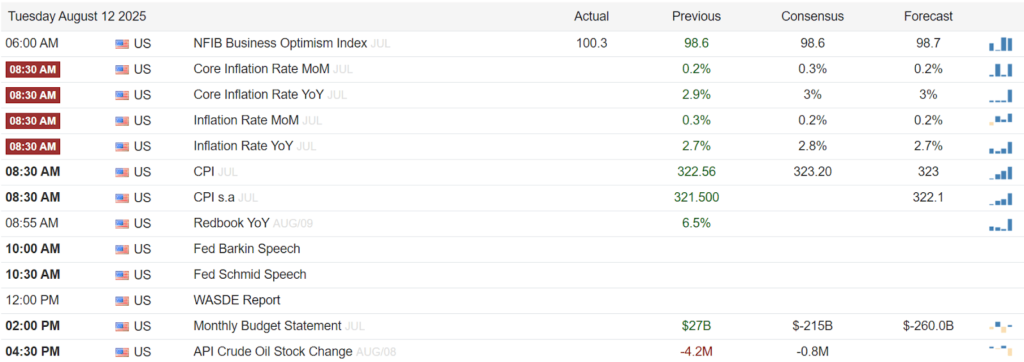

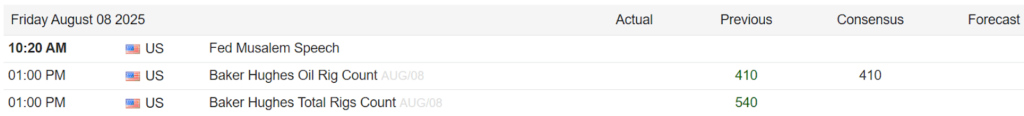

MARKET NEWS 📰

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull. com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull. com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull. com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

*Sponsored Content:If you purchase anything through a link in this email other than RagingBull (RB) services, you should assume that we have an affiliate relationship with the company providing the product that you purchase, and that we will be paid in some way. RB is not responsible for any content hosted on affiliate’s sites and it is the affiliate’s responsibility to ensure compliance with applicable laws. We recommend that you do your own independent research before purchasing anything. While we believe in the companies we form affiliate relationships with, please don’t spend any money on these products unless you believe they will help you achieve your goals.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.