Happy New Year, 360!

FOCUS LIST🔎

TGL – Up over 300% in the pre-market on now news

NUS – Up over 19% in pre after announcing strategic transaction of Mavely for $250 Million

LIDR – Up over 11% in pre after announcing securities purchase agreement with institutional investor for $3.24M financing

Did you see Jeff’s Last Bullseye?

+$10,822 baby just buying the stock!

(Yes, he had a lot of shares, do the math 🧮)

Current Bullseye Pricing Ends Monday –

HOTLIST🔥

TGL – Up over 350% in the pre-market on now news

Treasure Global Inc. (TGL) through its subsidiary, ZCity Sdn. Bhd., offers payment processing and e-commerce services. The company provides an online-to-offline e-commerce platform that offers consumers and merchants instant rebates and affiliate cashback programs with e-payment solution and rebates in both e-commerce and physical retailers/merchant settings.

Despite no apparent news or catalyst TGL traded up over 350% in the pre-market. The stock was down over 99% in 2024 from over $5 to less than $0.20 in yesterday’s trade. It has sold of steadily in recent years.

Today however buyers have taken control of this beaten down stock pushing it up over 350% in pre-market trade.

The first target for bulls is the pre-market high at $0.9181. Above it, targets to the upside are $1.01, $1.30 and then $1.52.

Below $0.9181, targets to the downside are $0.75, $0.57, $0.46, $0.40, $0.30, $0.25 and then a gap fill at $0.1895.

NUS – Up over 19% in pre after announcing strategic transaction of Mavely for $250 Million

Nu Skin Enterprises Inc. (NUS) together with its subsidiaries, engages in the development and distribution of various beauty and wellness products worldwide. It offers skin care devices, cosmetics, and other personal care products.

In the pre-market this morning, the company announcedthat its Rhyz Inc. subsidiary completed a strategic transaction with Later, a portfolio company of Summit Partners.

As part of the transaction, Rhyz sold its Mavely affiliate marketing technology platform to Later in exchange for approximately $250 million in the form of cash and a minority equity stake in the combined Later/Mavely business.

Approximately $33 million of such consideration will be paid to other equity holders in the Mavely business. In connection with the transaction, Mavely is expected to continue to provide certain technology and social commerce capabilities to support Nu Skin’s affiliate marketing business.

Shares of NUS traded up over 19% in the pre-market in reaction to the news.

The first targets for bulls is the resistance area around $7.98. Above it, targets to the upside are the pre-market high at $9.03, with $9.40 and $10.10 and then $11 above that.

Below $7.98, targets to the downside are $7.40, $7.14, $6.84 and then a gap fill at $6.56.

Did you see Jeff’s last Bullseye on Monday? SATX for the win!

(prices set to increase from $297 —> $899 Monday)

LIDR – Up over 11% in pre after announcing securities purchase agreement with institutional investor for $3.24M financing

AEye Inc. (LIDR) together with its subsidiaries, provides lidar systems for vehicle autonomy, advanced driver-assistance systems, and robotic vision applications in the United States, Europe, and Asia-Pacific.

In the pre-market this morning the company announced that it had entered into a securities purchase agreement with an institutional investor for $3.24M financing.

At the closing under the Purchase Agreement, which will occur upon certain customary conditions being satisfied as provided in the Purchase Agreement, the Company will issue to the Purchaser (i) a senior unsecured convertible promissory note in the aggregate principal amount of $3,240,000 for an aggregate purchase price of $3,000,013.20 (the “Note”) and (ii) a warrant (the “Warrant”) to purchase up to 805,263 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”).

The Note, subject to an original issue discount of 7.4%, has a term of eighteen months and accrues interest at the rate of 7.0% per annum. The Note is convertible into Common Stock, at a per share conversion price equal to $2.22, subject to adjustments noted in the Note (the “Conversion Price”).

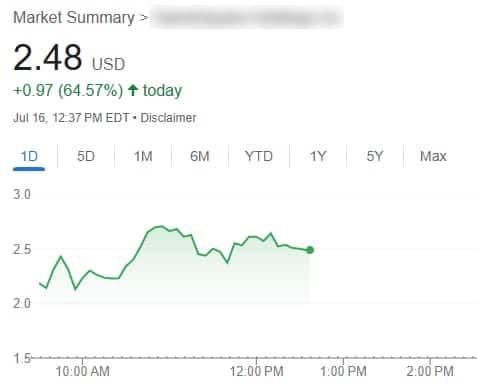

Shares of LIDR traded up over 11% in the pre-market in reaction to the news.

The first target for bulls is resistance at $2.02 with the after-hours high at $2.15. Beyond that, $2.40, $3 and $4.20 come into play.

Below $2.02, targets to the downside are $1.87, a gap fill at $1.77 then $1.70, $1.60, $1.50, $1.30 and then $1.20.

MARKET NEWS 📰

P.S. Make sure you text “RAGE” to (888) 404-5747 to get all of our latest HOT STOCK ideas!

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull. com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull. com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull. com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

*Sponsored Content: If you purchase anything through a link in this email other than RagingBull services, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything. We believe in the companies we form affiliate relationships with, but please don’t spend any money on these products or services unless you believe they will help you achieve your goals.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.