What Is a Box Spread Option?

A box spread option means buying a bull call spread along with the corresponding bear put spread. It is a common arbitrage option, wherein both vertical spreads have the same strike price and expiration date. Box spread options are also commonly referred to as long boxes.

Why Use an Options Box Spread?

Options box spread strategies allow traders and investors to take advantage of both long and short positions. This simultaneous, or arbitrage, spread strategy can allow traders to quickly lock in profits with better-managed risk.

Box spreads can offer better risk-balanced profit potential to traders who can find them; spotting them often presents the biggest challenge.

These spreads happen quickly and are difficult to fill. Individual traders may spot one or two, however, don’t go out of your way to find them. We’ll explain what they are and why most of us cannot capitalize on them.

Box Spread Options Fundamentals

A box spread combines a bear put spread and a bull call spread. Traders look to take advantage of an arbitrage that may exist for a short time. A box spread consists of buying one put option at or near the money and selling one put option at a lower strike price. You then buy a call option at or near the money and sell one call option at a higher strike price.

Expiration Value of Box = Higher Strike Price – Lower Strike Price

Risk-free Profit = Expiration Value of Box – Net Premium Paid

Here’s an example:

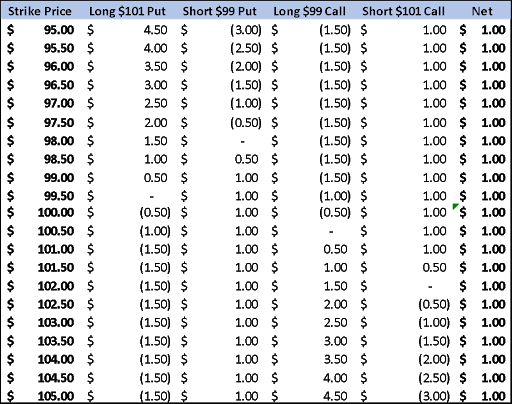

- Stock ABC is trading at $100 with the following options available one month out

- You buy $101 put at $1.50

- You sell a $99 put at $1.00

- You buy a $99 call at $1.50

- You sell a $101 call at $1.00

The payout diagram helps to see how things play out at different prices:

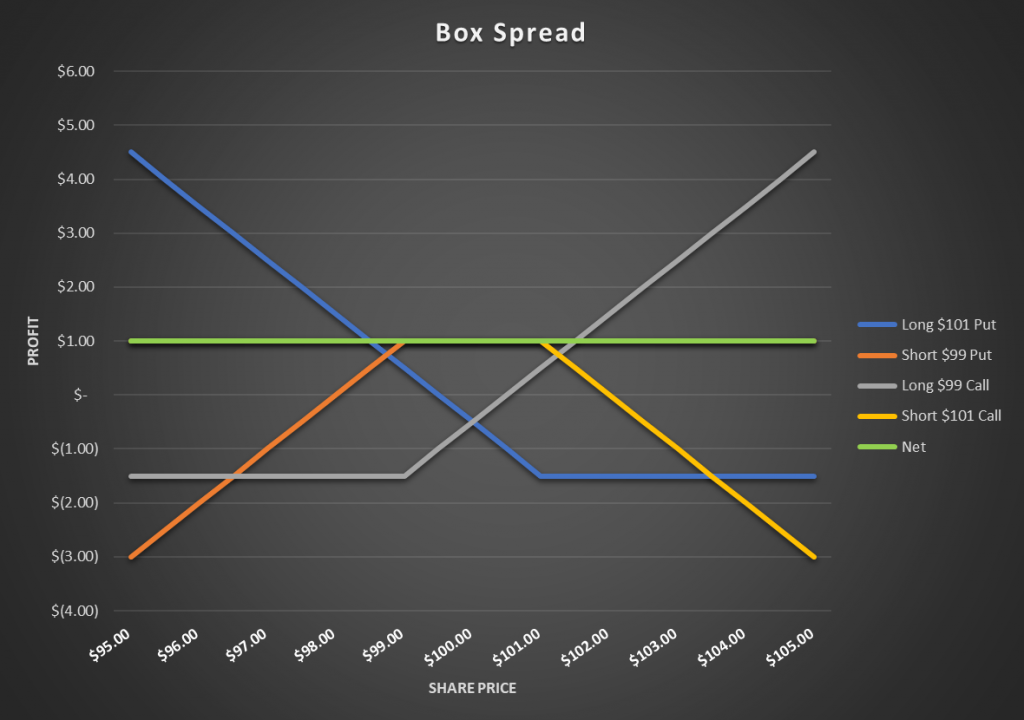

Your Payoff diagram looks like this:

This can essentially mean “free money” – at least in this case. You won’t often come across opportunities like this with highly liquid products. However, you will see this from time to time when short-term market demand shifts occur that create the imbalance.

The idea here is to profit from an imbalance in pricing that occurs.

How Do I Get In On This Free Money From Box Spread Options?

Let’s be clear: box spreads don’t occur often. And when they do, they don’t normally offer such lucrative payouts as the example above. Most of the time, you’ll get eaten by the spreads or commissions.

In fact, a study by Chaput and Ederington on the COMEX from 1999-2000 shows that box spreads made up around 0.01% of the trade volume. In fact, most of the opportunities disappear in less than a second.

Identifying these opportunities is the hardest part. Box spreads don’t need to have strikes laid out as above; the distance between strikes can be large. Also, you don’t need the distance between the call strikes and put strikes to be exactly the same. Your long put could be further in the money than the long call. Or your short legs of the trade could be different distances from the current strike price. And you still have to be quick with all these possible combinations.

You can use a few tricks to find possible opportunities:

- Increased option volume: You can use brokerage scanners to identify stocks and strike prices with large volumes.

- Rapid changes in volatility: When volatility changes quickly, it may not be uniform. Concepts like IV Skew can create openings when a stock’s implied volatility changes faster than normal.

- Awesome software: With so much data to crunch in a short time, computers give you the edge. Not too much work has been done to predict possible box spreads. Using algorithms or machine learning, you could be the first!

Similar Options Strategies to Box Options

Most of us will find a unicorn long before a profitable box spread, although that doesn’t mean that similar strategies don’t exist.

If you believe the market will move but aren’t sure of the direction, consider these options trading strategies.

- Long Strangle

- Long Straddle

- Long Iron Butterfly

- Short Iron Condor

The reverse iron butterfly and Short Iron Condor both allow you to act primarily as the options seller.

This puts time decay on your side. However, in this case you are trading a higher probability of success for limited profits.

In fact, these strategies happen to be a core component with our Total Alpha, which aims to provide consistent income, and also within some of the trades in our Options War Room service.

Both long strangles and straddles allow you to capture moves with maximum profit potential. The downside is they cost more and this lowers the probability of success, as well as puts time decay against you.

Box Spread Options Risks

While box spreads may seem risk-free, they may not be and there are actually quite a few risks associated with box spreads.

- Commissions – Most box spreads offer extremely limited opportunities. Not only do you have to execute them but you also need to close them to make a profit. This means commissions on all 4 legs of your round-trip strategy. If you’re dealing with a spread of 1 penny or less, you won’t make enough to overcome your fees.

- Early Assignment – Having any short options position means you always risk early assignment. Here you have two short legs, both of which can risk early assignment. When this occurs, you’re better off collapsing the trade. Remember, if you get assigned early, you may incur additional fees from your broker.

- Poor execution – Not so much a risk, as these trades are extremely difficult to fill. You’re dealing with arbitrage that lasts less than a second. This means you have to execute the order and get filled. Unless you are a floor trader or run a high-speed firm, you’ll find plenty of difficulties here!

Box Spreads: Final Thoughts

If you didn’t gather by now, box spreads are like the Dodo bird. They may have once existed, but now we only read about them. High-speed firms may effectively execute these options box spread trades. As for retail traders, we’re better off working with solid, proven strategies.